Bond Banking Meaning

An investment bank may also assist companies. A FINANCIAL SECURITYissued by a company or by the government as a means of borrowing long-term funds.

Treasury Bond T Bond Definition Example How It Works

Ready to support us.

Bond banking meaning

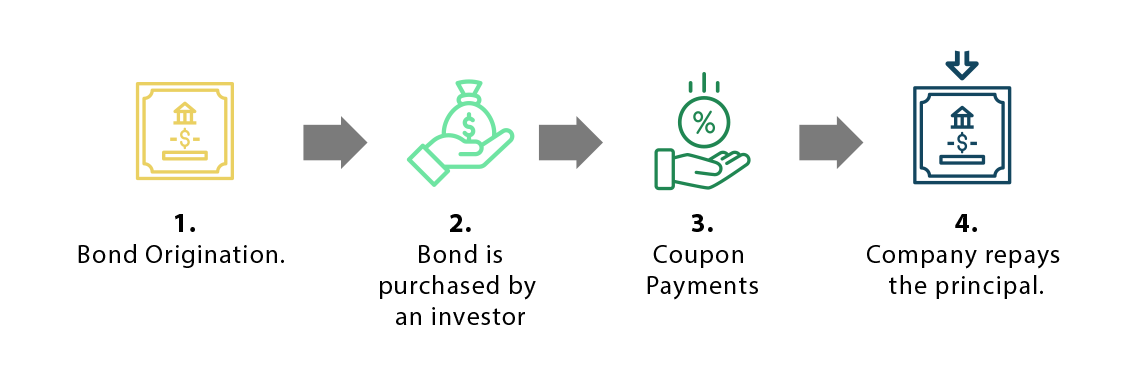

. At the maturity date you will be paid back the 1000 par value. Bonds and sukuk are issued to investors and may be used to raise capital for a firm. Share the link with your friends or email us at email protected to help us further improve the. The list of Bond abbreviations in Banking.The investor loans some of his or her money to the borrower who agrees to repay the debt when the bond comes to term which is usually several years down the road. This means that at some point the bond issuer has to pay back the money to the investors. Traditionally associated with corporate finance such a bank might assist in raising financial capital by underwriting or acting as the clients agent in the issuance of securities. The list short form for Bond abbreviation in Banking.

This bond bank then issues bonds for sale ie. A bond by contrast is defined as a debt instrument issued by a company or public administration and sold to investors in the financial markets with the aim of securing resources to fund itself. An investment bank is a financial services company or corporate division that engages in advisory-based financial transactions on behalf of individuals corporations and governments. Bonds have a maturity date.

Sukuk investors receive profit generated by the. The bond has a par value of 1000 a coupon rate of 5 and 10 years to maturity. Whereas tenor refers to the length of time remaining in a contract maturity refers to the initial length of the agreement upon its inception. The issuer of the bond promises to return the money plus previously agreed interest payments coupon to the purchaser of the bond.

Certificates of Accrual on Treasury Securities. Do you enjoy All Acronyms as much as we do. Bonds have the benefit of a predictable usually income stream and the ability to sell it if that suits your need. Bonds are typically issued for a set number of years often 10 years plus being repayable on maturity.

Companies or governments issue bonds because they need to borrow large amounts of moneyThey issue bonds and investors buy them thereby giving money to the people who issued the bond. They are issued in units of a fixed nominal face value and. Find banking definition of Put bond with DhanGuard banking dictionary. For example municipal bonds can be issued on the open market--where they compete against a range of other investment products such as shares or bonds offered by other governments.

Bank bonds are bonds that are issued by banks. DhanGuard banking dictionary is an easy to understand guide to the language of law with banking words and definitions explained in plain and simple language. Need to know how Bond is abbreviated in Banking. A bond is a promise to pay.

As with any type of bond bank bonds are a debt instrument. Offering a return of interest paid over a specified time period of maturation in a variety of markets. Find banking definition of Payment-In-Kind PIK bond with DhanGuard banking dictionary. DhanGuard banking dictionary is an easy to understand guide to the language of law with banking words and definitions explained in plain and simple language.

Indemnity Bond Meaning In Banking 2021 Indemnity bond is a bond that promises to indemnify the obligee against losses stemming from the principals failure to perform businessdictionary 2018Fill out securely sign print or email your discharging indemnity secured funding bond form instantly with signnowAn indemnity bond is a bond that protects indemnifies a third party from lossThe. The bond will return 5 50 per year. Bonds have credit ratings indicating the ability of the issuer to repay and may be insured. Both are considered to be safer investments than equities.

A bond is a contract between two companies. It takes precedence in bankruptcy and bond holders essentially become the new owners of the issuer. A bond bank is an independent entity created by the state that consolidates local bond issues into a single pool to offer better financing options. Say you purchase a bond for 1000 present value.

For example if a 10-year government bond. A bonds price equals the present value of its expected future cash flows.

/shutterstock_151894871-5bfc320546e0fb0083c1a809.jpg)

4 Basic Things To Know About Bonds

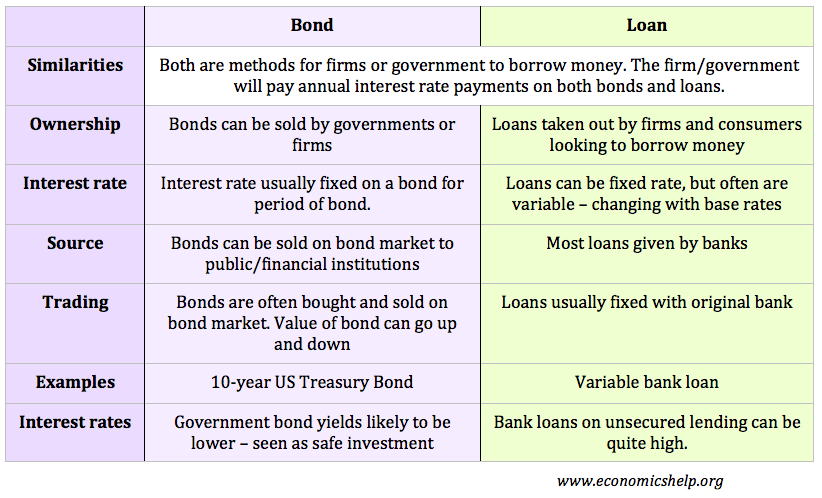

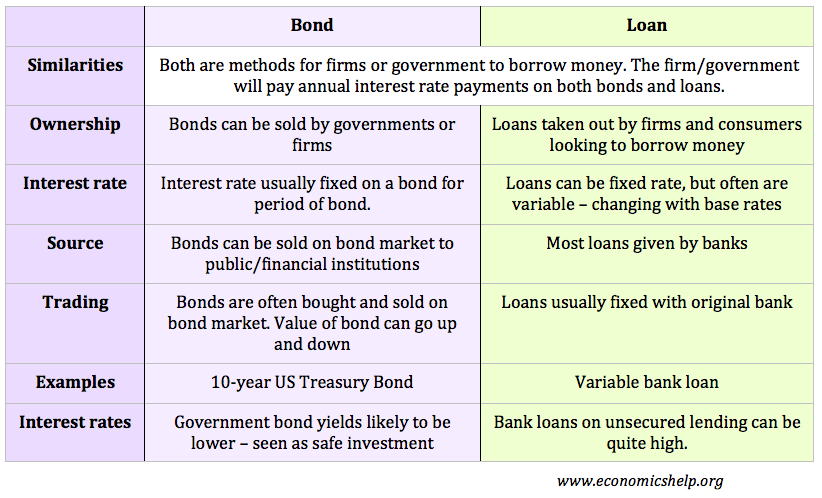

Difference Between Bonds And Loans Economics Help

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

How Are Bond Yields Affected By Monetary Policy

Bond Definition What Are Bonds Forbes Advisor

/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)

Everything You Need To Know About Junk Bonds

/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Posting Komentar untuk "Bond Banking Meaning"